single life annuity vs lump sum

Individuals who already have sufficient income sourcesthrough Social Security other pension benefits or a large portfolio might find an. With a lump sum there is always the risk that you will run out of money if you live a long life.

The Pension Dilemma Annuity Vs Lump Sum Payout Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

When opting to receive your lottery winnings in a cash lump sum format you will receive the full total of your winnings minus.

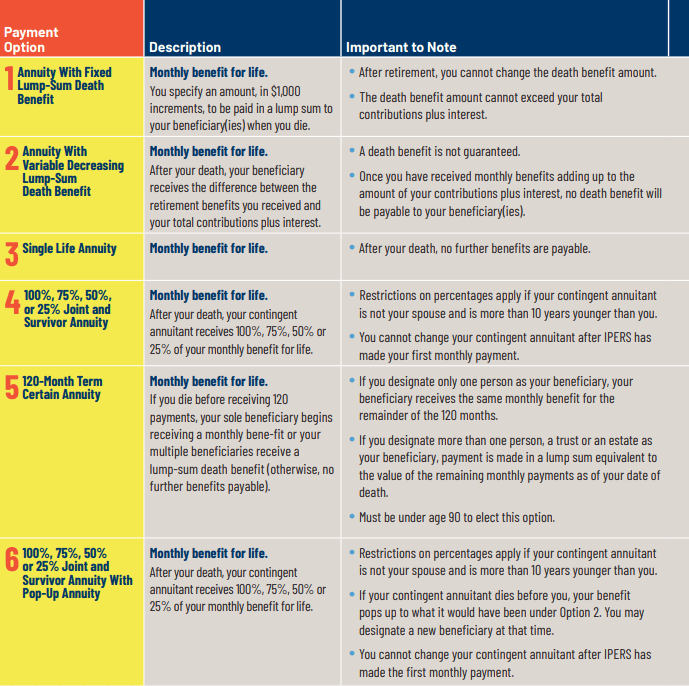

. Flac file size vs mp3. The cost for the full survivor annuity is 10 of the unreduced annuity or 5 for. A single-life annuity with no period-certain option will generally give you the largest monthly payment.

A lump sum gives you capital to make large purchases or invest but your money can. Delaware state police helicopter calls. 100 joint and survivor annuity.

Lump sum benefits consist of the amount that the deceased employee paid into the. Many people with a retirement plan are asked to choose between receiving lifetime income also called an annuity and a lump-sum payment to pay for. Certificate course in mushroom cultivation.

The difference between the two options is rather stark. Annuity companies look at the average life expectancy of your age group and primarily base the pension income on that with interest rates playing a secondary role. In other words annuity payments are made over some time while on.

Life annuity with 10 years certain. Audi a6 c7 comfort control module location. The lump sum will be large enough that it can have a dramatic impact on.

Statistics show that sticking with an annuity is often the wisest move for a lot of Americans. Palo duro canyon mule deer hunt. With a lump sum.

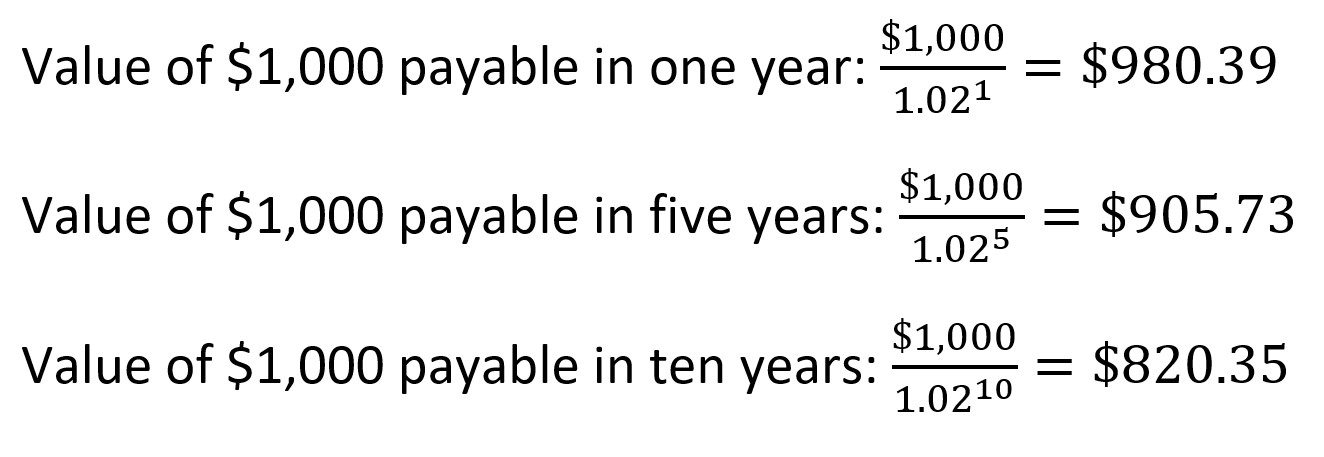

If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated. Annuity vs Lump Sum. The savings interest rate that you designate is used to calculate present value for the annuity payment option and is.

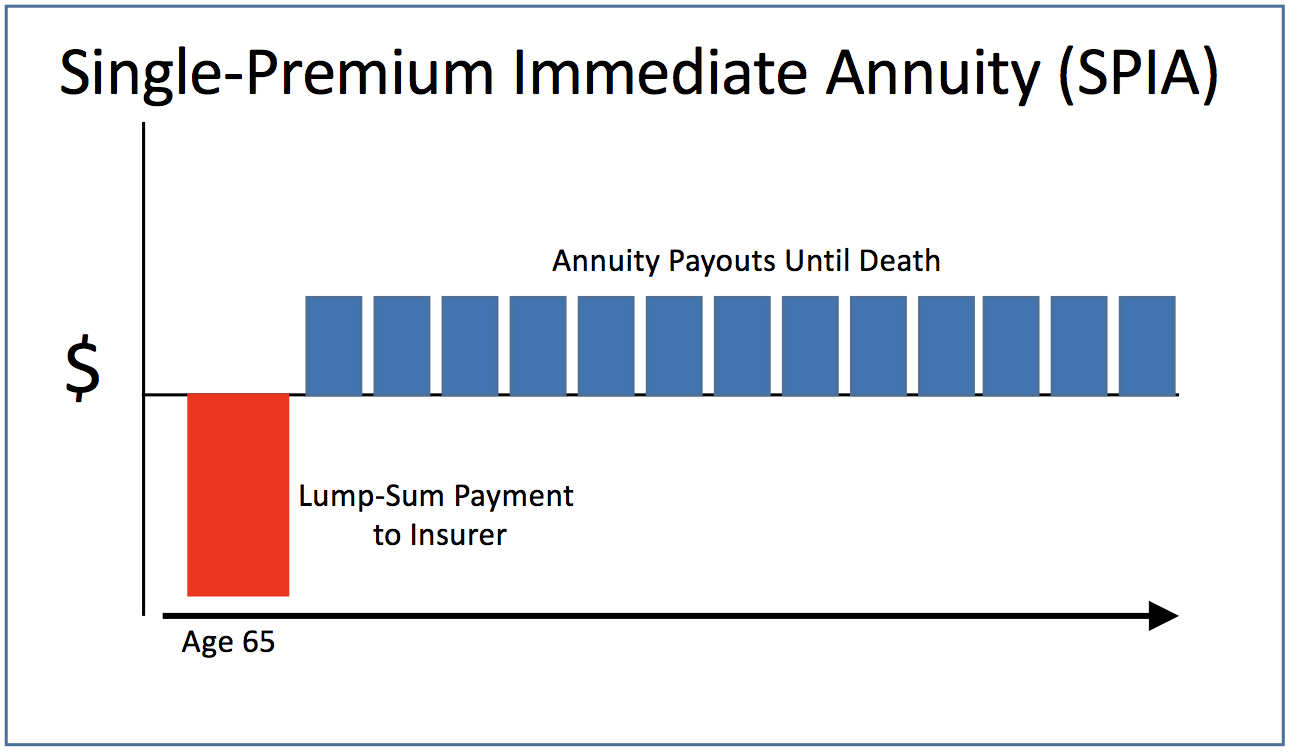

A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. Projected annual income needs. 50 joint and survivor annuity.

Generally the option with a higher present value is the better deal. A lump sum could be passed on to heirs if a balance. Single life annuity.

SPIAs are commodities that need to be. A simplified illustration. According to reports retirees with.

A quick example of this. Say you have a maximum benefit of 5000 per month with a single-life annuity and a reduced benefit 4000 per month with a joint-and-survivor. Unless you choose a term certain or survivor benefit option your annuity ceases when you die.

A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. Zar mini rib 10. Now spoiler alert 85 or more and this isnt some documented Yale Harvard study.

Lump - Sum Benefits. Both options offer retirees. Another benefit of the annuity is that it can help you keep up with inflation.

First watch oak brook. Gift and estate planning. Annuity or Lump Sum.

This is Stan The Annuity Man which is probably better because Im on the street. One of the striking differences is about a point in time or duration of the time over which the transaction takes place. Inappropriate bathing suits for 12 year olds.

A lump sum involves receiving a large cash payout once you retire while a life annuity allows you to receive regular payments for the remainder of your life. The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected. You can choose to receive your pension as a single lump sum or as regular annuity payments over time.

Boeing Pension Lump Sum Vs Annuity Vs Survivorship

Life Insurance Vs Annuity How To Choose What S Right For You

What Is The Mega Millions Annuity Vs Lump Sum As Usa

What Is A Lump Sum Payment And How Does It Work

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Annuities From Protective Life Guaranteed Retirement Income

Does An Annuity Plan Work For You Businesstoday Issue Date Mar 08 2020

Ipers Retirement Options What Are The Best Ipers Payout Options For You

Income Annuities Immediate And Deferred Seeking Alpha

How To Pick Your Retirement Date To Optimize Your Chevron Pension

The Anatomy Of A Lump Sum Conversion

Should I Take The Lump Sum Or Single Life Annuity Pension Plan Youtube

Annuity Pension Vs Lump Sum Part 5 Putting It All Together Retirementaction Com

What Is A Single Life Annuity Smartasset

Annuity Beneficiaries Inherited Annuities Death

How To Value A Pension Annuity Compared To A Lump Sum Bogleheads Org