high low method machine hours

The information for 20x3 is provided below. Machine hours 24000 15000.

The High Low Method For Analyzing Mixed Costs In Accounting Youtube

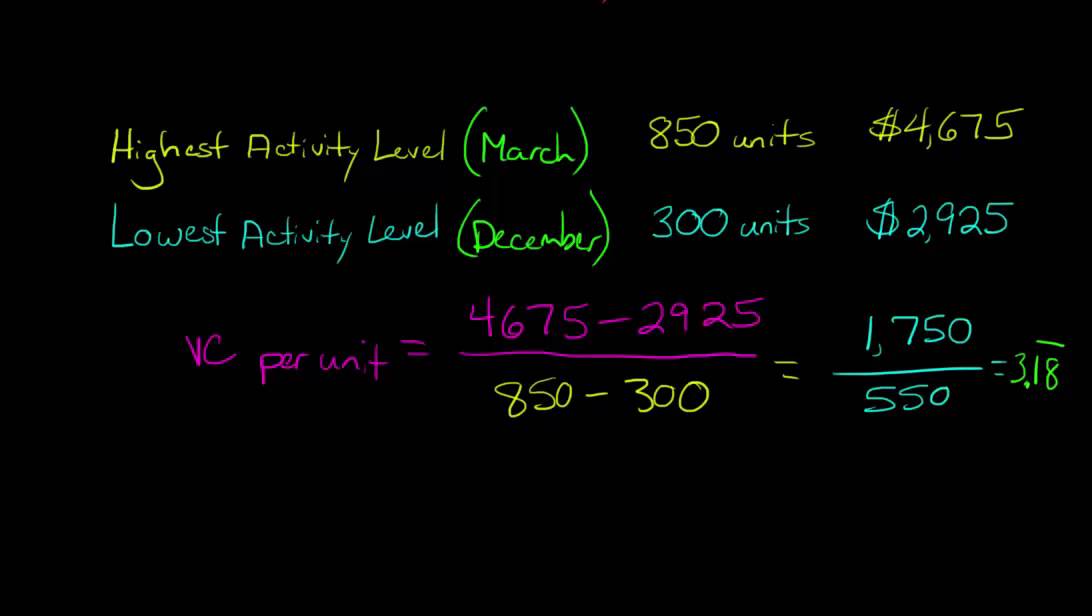

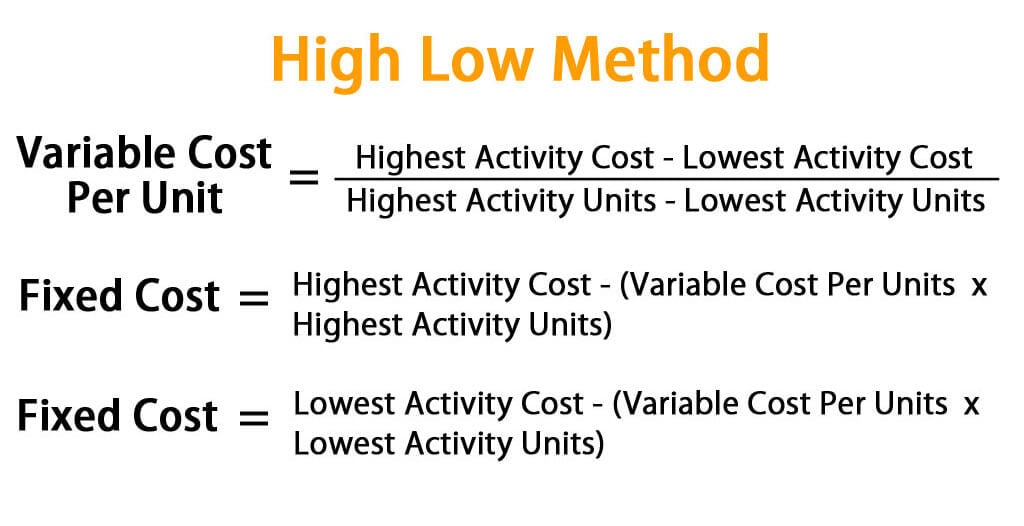

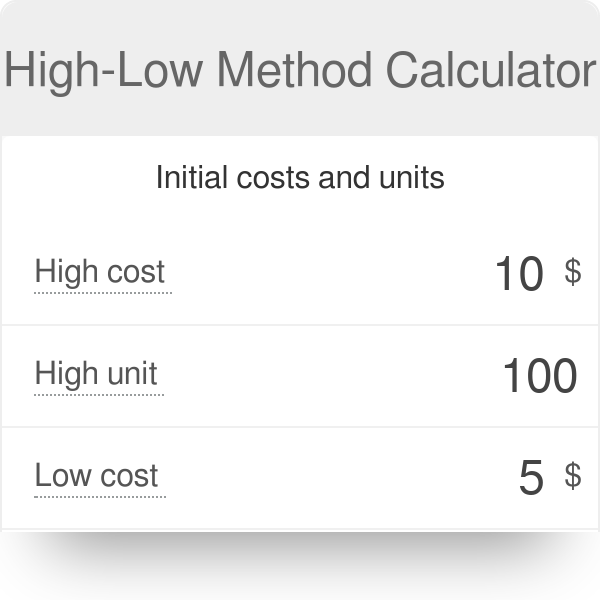

The high-low method involves taking the.

. High Low method is a way to calculate the variable and fixed cost element of total. In cost accounting a way of attempting to separate out fixed and variable costs given a limited amount of data. C 14330 d 26745 7.

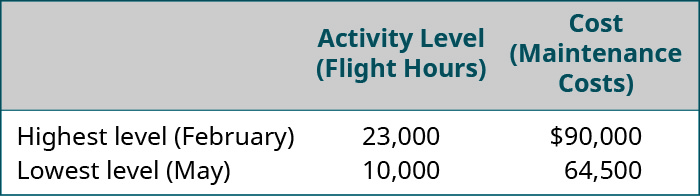

The highest and the. Given a set of data pairs of activity levels ie. Machine-Hours Maintenance Costs Highest observation of cost driver 140000 280000 Lowest observation of cost driver 95000 190000 Difference 45000.

Battle Company which uses the high-low method to analyze cost behaviour has determined that. Cost per month 39200 32000. Observed that at 21000 machine hours of activity total maintenance costs averaged.

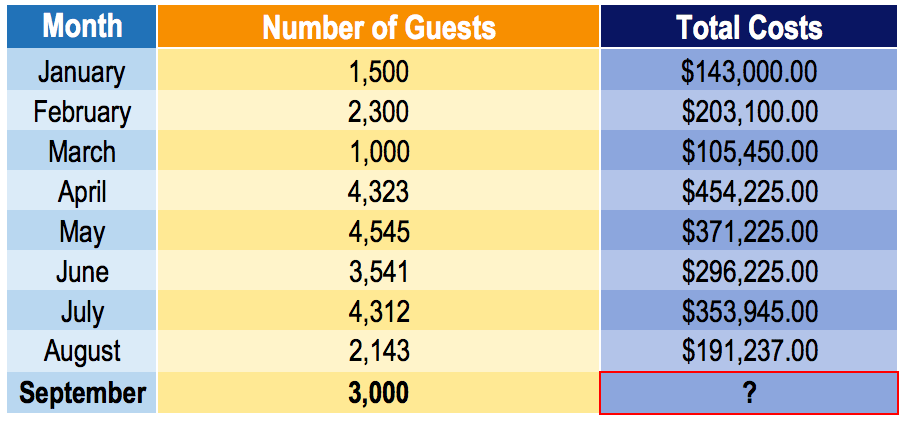

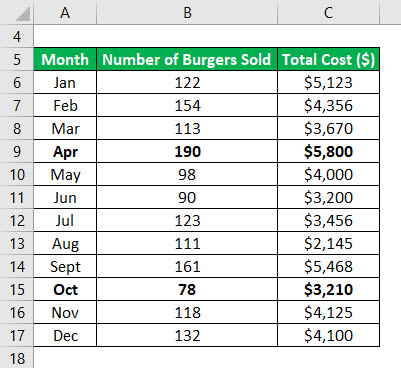

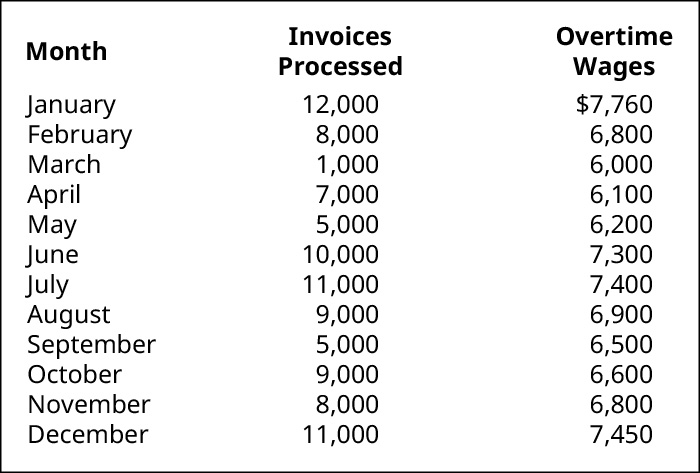

Quarter Work hours Cost 1. Use the high-low method to estimate the variable and fixed components of this cost. Month Maintenance Cost Machine Hours.

Hotlanta Inc which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. The Hunter Company uses the high-low method to estimate the cost function. Month Direct Labor Hours Maintenance Cost.

Variable utilities cost per machine hour 16 per. To solve this using the high-low method formula subtract the lower cost from the higher cost to get a numerator of 27675 then subtract the lowest number of units from the. Machine Hours 22000 32000 26000 24000 Cost 56000 May June July August Oa.

Units labor hours machine hours etc and the corresponding total cost figures high-low method only takes two extreme data pairs ie. Assume that the cost of electricity at a small manufacturing facility is a mixed cost since the company has only one electricity meter for air quality cooling. In cost accounting the high-low method refers to the mathematical technique that is used to separate fixed and variable components that are otherwise part of the historical cost that is.

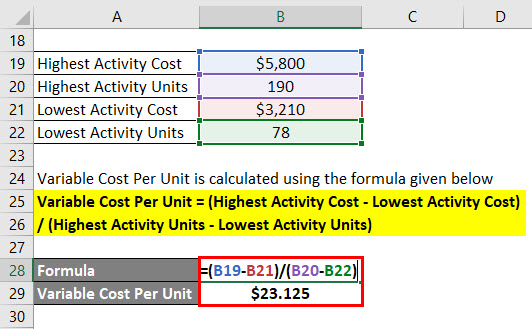

Variable utilities cost per machine hour Change in costhigh machine hour-low machine hour 4076-33881460-1030. Example of High-Low Method. Requirements Using the high-low method answer the following questions 1.

HIGH-LOW METHOD Key Terms and Concepts to Know Variable Fixed and Mixed Costs. High-Low method is one of the several mathematical techniques used in managerial accounting to split a mixed cost into its fixed and variable components. Plant activity is best measured by direct labor hours.

Use the high-low method to determine the hospitals cost equation using nursing hours as the cost driver. Compute the variable component rounding off to the nearest whole cent. Using the highlow method of analysis the estimated variable cost per machine hour is.

Assume that the relevant. Uses the highlow method to analyze cost behavior. A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver.

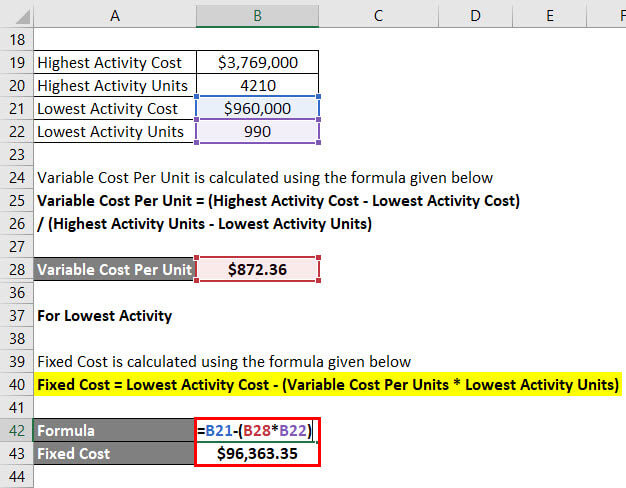

Machine-hours Labor Costs Highest observation of cost driver 400. Recent data are shown below. High Low Method is a mathematical technique used to determine the fixed and variable elements of historical costs that are partially fixed and partially variable.

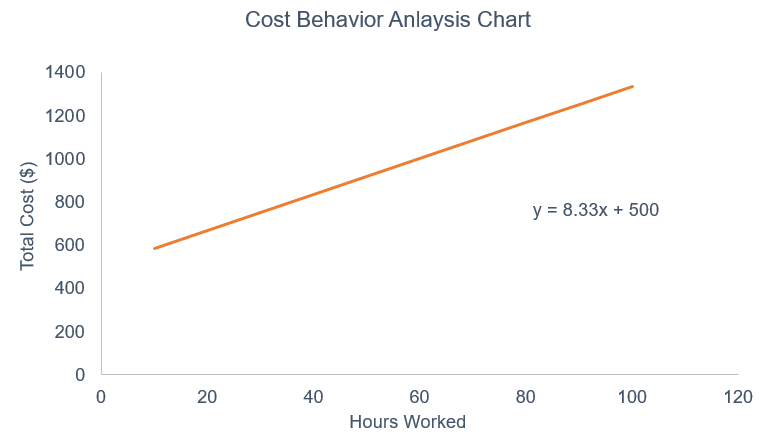

Round the variable cost to the nearest cent y 1310 x. Based on the following information calculate fixed costs per month using the high-low method. If factory overhead is Rs 3 00000 and total machine hours are 1500 the machine hour rate is.

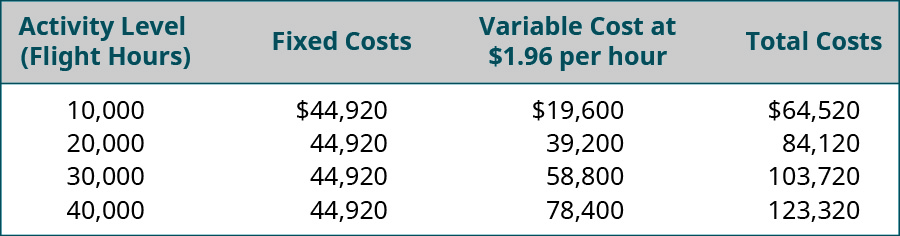

The utilities cost associated with 1110 machine hours will be 10505. The formula used in computing the rate is.

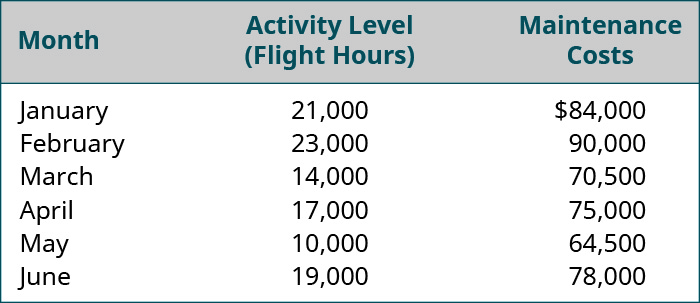

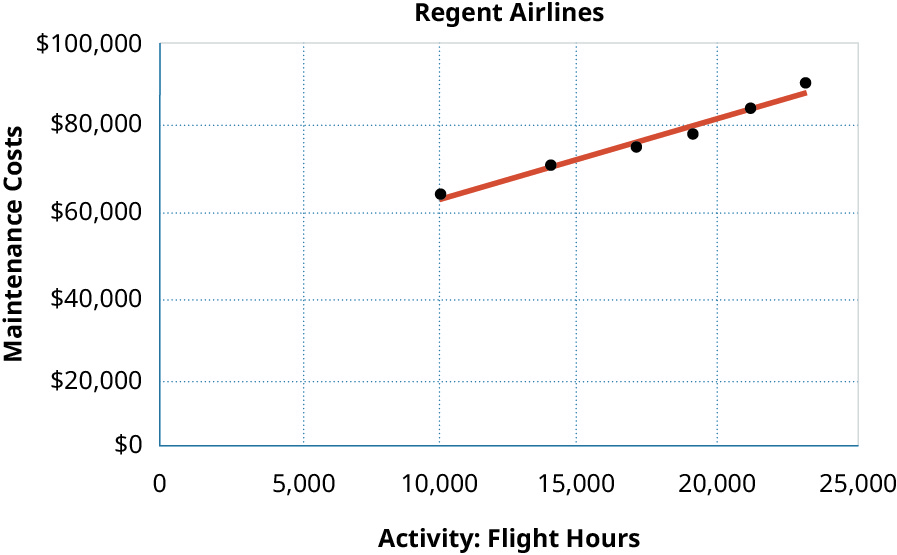

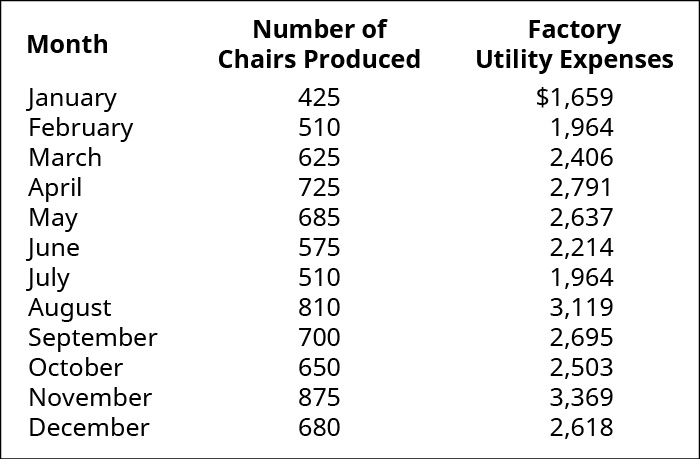

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

High Low Method Learn How To Create A High Low Cost Model

Air Changes Per Hour Calculator Cfm Based Formula Examples

Cost Behavior Analysis Analyzing Costs And Activities Example

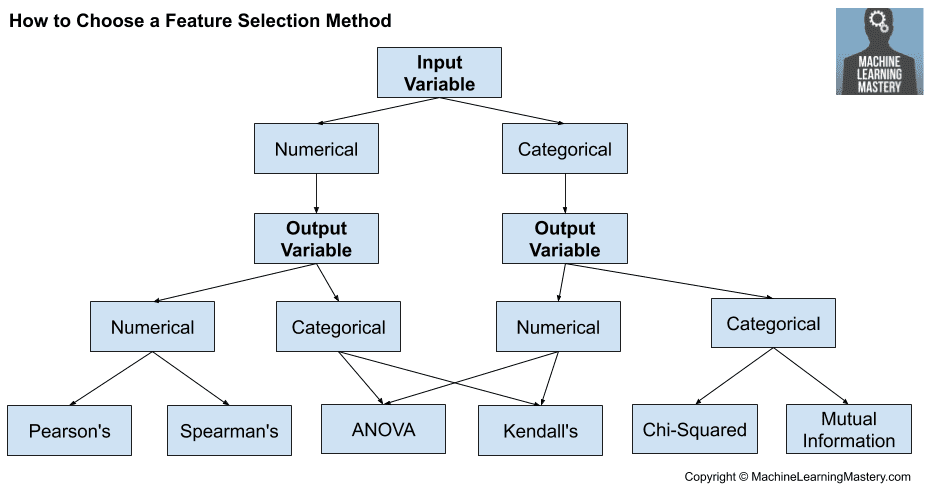

How To Choose A Feature Selection Method For Machine Learning

High Low Method Learn How To Create A High Low Cost Model

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

What Is The High Low Method Gocardless

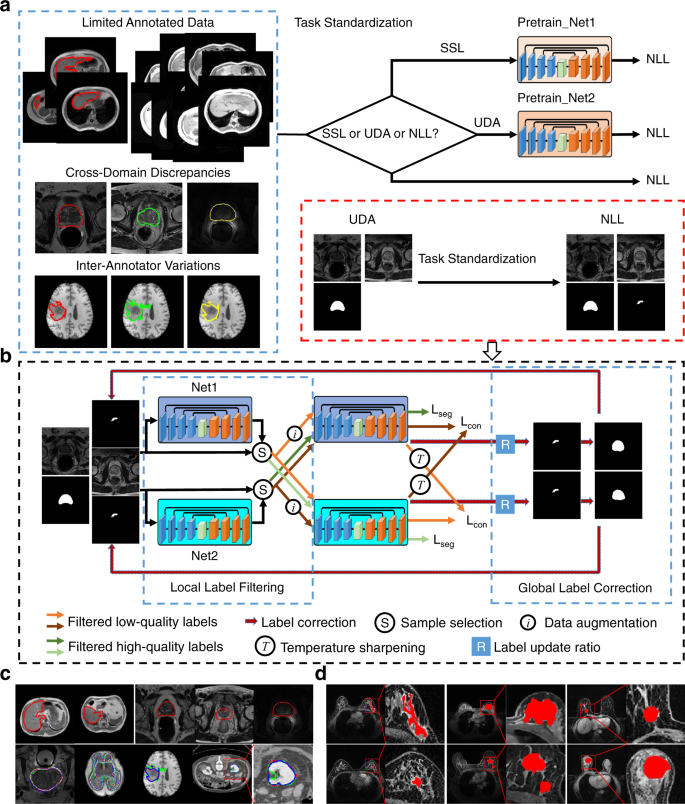

Annotation Efficient Deep Learning For Automatic Medical Image Segmentation Nature Communications

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Estimate A Variable And Fixed Cost Equation And Predict Future Costs Principles Of Accounting Volume 2 Managerial Accounting

/cost-accounting-b615845be6d5418e8b79152f473a902f.jpg)